“Next year will be a tough one across the board. That said, most executives were fairly confident next year won’t be any worse than the 12 months we’ve just experienced.”

This forecast has been the most difficult to write since I began doing this five years ago. Everyone agrees on the factors involved, but their predictions of the end result varied widely. As one executive told me, “You may as well throw darts as try to predict what’s going to happen next year.”

The Chicago Tribune also hesitated, saying “There are too many variables, too many uncertainties tied to unemployment, the credit markets, the rising number of foreclosures and the government’s bailout plans. Builders large and small are just too unsure of their businesses — and the overall economy.”

That’s simply not good enough. This magazine has established a reputation for the most accurate, reliable content in the industry, and this article intends to continue that tradition. (See “How this Forecast was Compiled” on p. 34)

After weeks of research and dozens of interviews with industry leaders, a few topics surfaced again and again. Hopefully these themes will provide some guidance as ICF related businesses plan the next 12-18 months.

Summary

Next year will be a tough one across the board. That said, most executives were fairly confident that we’re nearing the bottom of the market and next year won’t be any worse than the 12 months we’ve just experienced. They also expressed confidence that in the long run, the slowdown will prove beneficial.

There’s not going to be a big bounce back in 2009,” says Patrick Murphy of American PolySteel. “If companies can weather the storm and can sustain themselves through 2009, they’re doing well.”

“It is going to be a difficult year,” confirms Andy Lennox, marketing manager at Logix ICF, “but it’s not all doom and gloom. Like most everyone, we’ve had a crap year this year, but I don’t think next year is going to get any worse.”

“In the long-term, it will be positive for the industry as a whole,” says Gary Brown, vice-president at Amvic, a sentiment echoed by several others. “Those that can survive the next 18 months are going to be in a much stronger position,” he says. “Once we’re out of this, the industry will see double-digit growth again.”

Economy

The biggest factors, of course, are the economy and the general construction market. While politicians argue over who’s to blame for the historic recession we’re now in, here’s how the economists see it:

After the World Trade Center bombings in 2001, the Federal Reserve cut a key lending rate to near zero. That dropped mortgage rates to below 5%, and most people suddenly found it cheaper to buy a home than rent one. This prompted a building boom, which fueled even more speculation and risky lending. By 2005, at the height of the boom, a record 1.7 million homes were built. This led to a surplus of homes, which forced prices down. Falling home prices meant trouble for new homeowners who had taken risky loans, or borrowed more than they could afford. Suddenly they owed more than the home was worth. To make matters worse, because the Fed had been raising interest rates and tightening credit standards, they could no longer refinance. Unable to make their payments, lenders foreclosed, and put the homes back on the market.

So even though homebuilders had cut back on construction, the flood of foreclosures kept housing inventories at an all-time high. Prices kept falling. Soon, the investment banks that held the mortgages began to fail as well.

At present, homebuilding has virtually ground to a standstill, yet the housing inventory is still near an all-time high. Prices may be nearing the bottom, but customers are either too scared to buy, or can’t get financing as banks have virtually quit lending.

The lack of financing options is starting to trickle into the commercial sector, and jobs are being delayed or cancelled. The best, most feasible solution involves convincing the banks to begin lending again, so the market can work through the excess inventory.

Unfortunately, that’s not going to happen overnight.

“It’s been a very difficult year, economy wise, especially in

the U.S.” says Lennox. “There’s no realistic hope of changes in the next year.

“The downturn’s putting pressure on everybody,” he continues. “If you’re not properly managed, you’re not going to survive this one. It’s too long and too deep.”

“It’s very tough,” confirms Brown. “I’ve been through some downturns, but this one seems tougher, and may take a bit longer to get out of.”

Hank Pfieffer, COO of Reward Wall Systems, points out

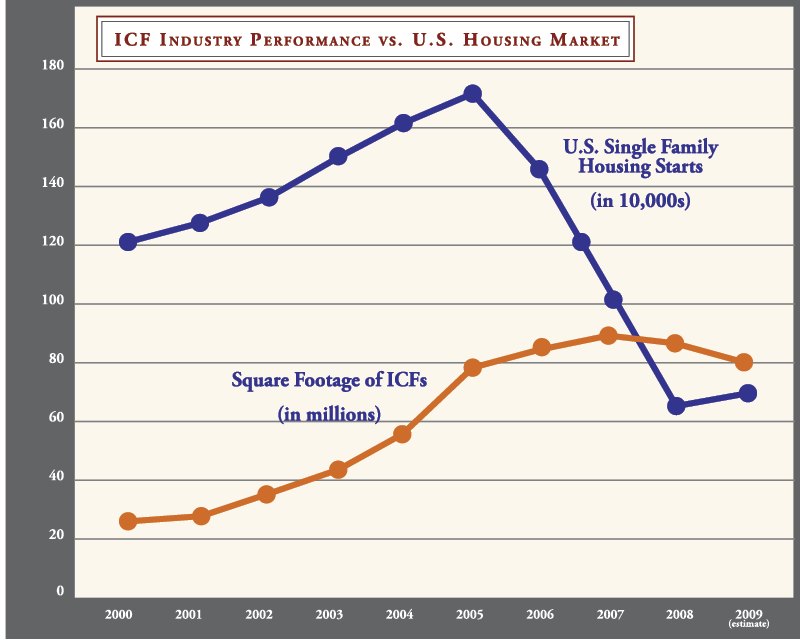

that the fact that ICFs have flat-lined underscores how popular foam forms have become. “We’re no longer immune from the overall market,” he states. “Our whole industry is following the general construction market more and more.”

Residential

The residential market has been hit hardest by the slowdown. Too show how far we’ve come since 2005, this year only 650,000 homes were built. That’s down 62% from the 1.7 million homes built 3 years ago. The NAHB predicts a modest increase in 2009 to 750,000 homes. By 2010, the industry will resume a sustainable level of about a million new homes annually.

“We expect housing starts to bottom in the beginning of next year,” states the Lehman Brothers Housing Report. “This will continue to reduce inventory, bringing supply back to normal by the end of next year.”

U.S. Treasury Secretary Henry Paulson told reporters at a White House press briefing that, “Until we stem the housing correction, until we have more stability in housing prices, we’re going to continue to have turmoil in financial markets.” He continued, “I believe that there is a reasonable chance that the biggest part of that housing correction can be behind us in a number of months. I’m not saying two or three months, but in months as opposed to years.”

Several signs indicate that once the market turns around, the recovery will be short and steep. Thomas Zimmerman,

a mortgage securities analyst at USB, predicts that new foreclosures currently flooding the market are likely to taper off by the middle of next year. Potential homebuyers who are sitting out the market right now will return in droves to buy homes once prices begin rising. Home sales have already stabilized in places like Las Vegas and Southern California as buyers snap up bargain properties.

“There may be some turning points not that far away,” Zimmerman said. “The really severe part of this collapse in the housing market may be behind us.”

For 2009 though, residential builders will face another tough year.

“This isn’t your typical recession,” says Jim Neihoff, director of residential at PCA. “ ‘09 is going to be a rough year for residential.”

Bruce Anderson president of Vinyl Technologies and maker of the popular V-Buck window system puts it more bluntly, “Residential is dead.”

Neihoff points out, though, that generally the first market down is the first to recover. He adds, “ICF contractors haven’t been hurt nearly as much as their wood-frame counterparts.”

That’s because virtually all residential ICF construction is custom-built, not-on-spec luxury homes. But these are declining as well.

“There’s a lot of factors,” explains Brown, at Amvic. “They delay selling their existing home because of depressed prices; they have trouble getting financing, etc.”

Bottom Line: If your company is heavily involved with the residential sector, it will likely be another dismal year. Best predictions are that residential ICF construction will be 10% down from this year. But those that can survive another year like the one that just past will be well-positioned for strong growth in 2010 and double digit growth in 2011.

Commercial

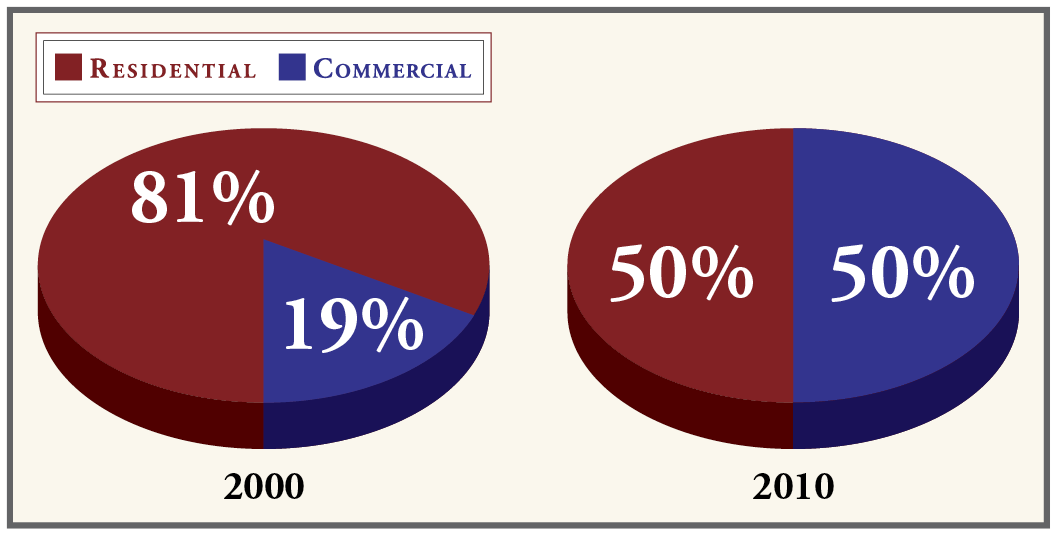

Commercial construction has chugged through the slowdown relatively unscathed.

“We have so much light commercial on our plate right now,” says Jim Buttrey, vice president at IntegraSpec. “Schools have turned onto ICF, churches remain strong, and the hospitality industry is also promising.”

“The education and hotel/motel sub-sectors are doing okay,” confirms Brown. “That will sustain the people that have gone after it.”

“Our ‘opportunity lists’ are quite long,” says Steve Reiter, marketing manager for Insulated Concrete Walls, a commercial installation subcontractor. “However, fewer and fewer jobs are coming to fruition because of financing, or delayed because of uncertainty of the economy.”

“People are really watching their pennies right now,” he continues. “We try to upsell and point out they get a better product, but there’s a fair amount of ‘cost-only’ mentality out there.”

But commercial usually lags behind residential by about a year, and signs of a downturn in the commercial market are starting to surface. Most of it is related to the “credit crunch,” the inability to get financing for otherwise viable projects.

The latest PCA forecast of cement, concrete, and construction predicts a 12% decline in 2009, nearly the same rate of decline as the 12.8% rate this year.

“The weak economy and tight credit conditions, coupled with severe job losses and the resulting decline in state government revenues, will translate into significant weakness for the construction industry through 2010,” writes PCA economist Ed Sullivan.

“The nonresidential construction market typically takes 18 months from the onset of better economic conditions to rebound,” he continues. “With weak consumer spending, this sector will be especially hit hard in retail construction.”

PCA predicts the commercial sector to begin to recover in 2011, with a return to near-record consumption levels by 2013.

Some say the turnaround for the commercial ICF sector could be even sooner. “Once the credit crunch is solved—probably in the first quarter 2009—the projects will go ahead,” says Buttrey.

Bottom Line: ICFs will continue to gain market share in the commercial sector, even as the general non-residential construction market slows down. Projects are being delayed due to credit issues, however, and pricing is extremely sensitive. If this clears up in the next few months, some projects may come through in time for the summer ‘09 construction season. Most of the jobs, however, won’t come through until 2010. ICF use in this sector next year will likely be flat, matching 2008 figures.

Regional Breakdown

Obviously, the forecasts above will vary regionally. One major regional difference is that Canadian construction markets haven’t seen the huge downturn U.S. markets have experienced.

In fact, ICF companies that do most of their business in Canada are growing. Quad-Lock, Arxx, and IntegraSpec, for instance, have added staff in the last few months. With the Canadian and U.S. dollar reaching parity, however, Canadian-brand ICFs are finding it increasingly difficult to win jobs in the U.S. This is especially true for Canadian companies with no U.S. molding facilities.

Lennox, at Logix, also points out that the credit crunch is starting to trickle into Canada, and projects are being delayed or cancelled in northern markets.

So while Canada performed significantly better than the U.S. in 2008, the difference probably won’t be as notable next year.

In the U.S., ICF sales predictions vary dramatically. Anderson, the V-Buck executive, commented that sales of his product seem to mirror the political maps drawn up prior to the presidential election. “We’re getting lots of hits in the red states, more than the (politically) blue states,” he says. “The Rocky Mountain states are doing really well, but they’re low population areas.” He also noted that states along the Gulf Coast—Texas, Alabama, and Florida—are also doing relatively well, as are the Carolinas.

Wild Cards

As with any forecast, there are a few ‘intangibles’ whose influence is difficult to predict. The green building movement, for instance, won’t likely have a major effect on the industry in the next 12 months, but over the next 12 years its influence will be enormous. The changes going on at the ICFA and the move toward industry consolidation will also have long-term effects.

Green Building: “The green building movement isn’t going away,” says Jim Neihoff.

Like air conditioning and elevators, green building will revolutionize the type of structure we live and work in.

“Green building is not a trend or a fad,” says Rovert Coveney, vice president of Arxx Corp. “It represents a permanent shift in the market.”

Murphy, at PolySteel, agrees. “Sustainable building is already a major force in the industry. It will become the defining construction trend of our lifetime. The sooner that ICFs connect with the message of green and sustainability, in a comprehensive and meaningful way, the sooner they will grow.”

Coveney notes that with the slowdown, conventional builders are wanting to differentiate, and ICF companies—and their distributors—who are able to connect with these builders will have a significant advantage when the market turns.

Reiter, at ICW, says the movement is already helping to keep his crews busy. “Business is not gangbusters right now,” he said, “but we’re in a great position because we’re green. A large

percentage of what is being built right now is green or trying for LEED certification.”

Buttrey notes that ICFs are a near-perfect technology for capturing the green market. He claims that it is the only truly “green” concrete construction method, and that it integrates flawlessly with geothermal, solar, and other alternative energy systems.

Whether this becomes the wave that catapults ICFs into the mainstream, or merely another missed opportunity remains to be seen.

Consolidation: Five years from now, the ICF market will look significantly different than it does now. American PolySteel, named in 1998 as the most widely recognized brand of ICF, was purchased by Arxx Corp. this summer. A few months later, Arxx purchased Eco-Block another top-ten ICF brand. (See stories in the Aug. ’08 issue for additional details.) All indicators point to yet another acquisition before year’s end.

“It’s a sign of a maturing industry,” says Neihoff. “In a down economy, the well-managed firms with a solid product will survive and the others will end up by the wayside.”

Everyone interviewed for the article agreed that consolidation was good for the long-term growth of the industry, even if it creates some short term upheavals.

“Consolidation allows companies to achieve economies of scale,’ says Pfieffer, at Reward. “The market was already consolidating on its own around a few systems. There’s probably only five or six companies that can compete anywhere in the country, and we’re seeing less and less of the systems outside this small group.”

A “big three” in the industry has emerged, with Logix, Nudura, and Arxx Corp. accounting for more than half of all ICFs sold.

Second tier companies, which are likely about half the size, are jockeying for position. BuildBlock has made major gains in market share over the past year, and Greenblock Worldwide remains extremely well-capitalized.

“We do have some money,” confirms Reiter, “and we’re going to position ourselves to be the industry leader when the market turns around… We’d consider an acquisition if the right thing comes along.”

Whether or not ICF companies survive depends on two factors: if they were well-managed prior to the slowdown, and if their product can handle commercial applications. One

executive, who preferred to remain anonymous, pointed out that the two ICF brands most heavily identified with residential construction, American PolySteel and Eco-Block, have already been acquired.

Marketing muscle will also become increasingly vital. “In a few years,” Coveney says, “those doing less than $10 million annually won’t have access to the marketplace.”

Of course, small nimble companies have always been able to remain profitable by outrunning or outmaneuvering the large players. And Arxx Corp. has some serious management decisions ahead as it sorts out its product line.

Says one executive, “What they do will shape the direction of future consolidation. Competitors will make decisions in reaction to that.”

Conclusion

Despite the cautious predictions for next year, everyone interviewed indicated the long-term outlook for insulating concrete forms is quite positive.

“We’re continuing to build a strong following in the design community,” notes Pfieffer. “In the long-term, we see a groundswell that will pay off well for the industry in 2010 and beyond.”

“ As long as there’s a building being built, we are going to be in contention as a building material,” says Seibert. “We have an advantage they don’t, in that we’re selling true value.”

“We’re just going to watch every dollar,” says Lennox, “and when we come out of it, it will be positive for the whole industry. 2009 will end up being an okay year.”

How This Forecast Was Compiled

This 2009 Industry Forecast is the most exhaustively researched article in the magazine’s history.

All 15 of the leading ICF brands were contacted, and I interviewed the president, national sales manager or other senior-level executive at nearly all of them. In addition I spoke at length with several auxiliary manufacturers, who provide products across the industry, and were able to also provide valuable perspectives. These include makers of bracing, window bucks, ICF accessories, etc.

In addition to the individual companies, I spoke with the ICF expert at all of the relevant trade associations including the Portland Cement Association (PCA), Concrete Home Building Council (CHBC) and the Insulating Concrete Forms Association (ICFA).

General construction forecast data was drawn from predictions published by McGraw-Hill, the National Association of Home Builders (NAHB), the PCA and various reports published by the Associated Press.

Lastly, I spoke with a dozen or so distributors and contractors across the United States and Canada to get their regional perspectives as well.

Obviously, the article does not quote every source that contributed insights. Nevertheless, I greatly appreciate their willingness to share their insights and expertise. It is only because of them that this has become the most accurate source of ICF information in the industry.