Six months ago, a Boston apartment building five miles from my office went up in flames. It was under construction at the time, but the six-story structure was nearly complete. The fire reportedly started on the roof. It destroyed the roof deck. The deck collapsed and the flames dropped down to the next floor, and then the next and the next, until the fire reached the ground. The developer had insurance, but had to start construction over.

One month later, a near-rerun occurred in the town of Waltham, this time two miles away from me. A major complex of five 4- and 5-story apartment buildings under construction caught fire and the buildings collapsed. According to the Waltham Fire Chief, what was left of the buildings consisted of a “large pile of debris” (Boston Globe).

In both cases the buildings were wood frame construction.

Around that time, the National Concrete Ready Mixed Association (NRMCA) asked my research group to find out how the cost of building insurance differed for an apartment building constructed with concrete instead of wood frame. This could serve two purposes. First, it would tell us how much money in the form of insurance premiums one might save by building with concrete. Second, the difference in insurance premiums would give us an idea of the difference in risks and potential property losses using different materials. The insurers are the people who actually have to pay for the property damage, and if they set the rates at a certain level it’s generally because they feel that’s how much they need to cover the potential cost.

We gathered quotes from insurance agents across a range of U.S. cities and found them to be lower for ICF concrete construction in every case—regardless of region and regardless of whether the insurance was for a building under construction or a building that was completed and in operation.

Background

About a decade ago various building jurisdictions around the country began permitting the construction of taller multi-unit residential buildings with wood frame. In practice most of these structures use 2×6 studs and plates in the structural walls and engineered wood trusses for the floor decks and roof. In 2009 the International Building Code increased the height of such buildings that could be constructed without special provisions to six stories.

The argument in favor of permitting more wood frame construction was almost always cost. Municipalities frequently cited the need for reduced costs to help encourage construction in the wake of the 2007-2008 financial crisis. More recently they have argued that wood construction is important to the creation of affordable housing units as population has boomed in some areas. Now it appears that one downside to the supposed construction savings is greater risk of damage from disaster and greater insurance cost.

NRMCA tries to keep track of reports on wood frame apartment buildings around the U.S. that have burned down. It shows that we in Massachusetts are far from unusual. Their informal tally of news articles shows more than 100 major low- and mid-rise wood apartment fires in the past three years. No one knows how many more have escaped their notice.

In theory, the fire damage can be controlled. Many sources have claimed that wood is “safe” after the building is complete. Their reasoning is that during construction, fire suppression sprinklers and alarm systems are not activated. This makes the building vulnerable. But after work is complete and the systems are on, they are supposed to prevent the spread of fire and reduce the risk of damage. Nonetheless, there are many examples of wood frame apartment buildings with these systems that have burned to the ground.

We also have to remember that the world gives us other types of disasters. High winds and flooding can be destructive as well. And losses from these disasters are not likely reduced by fire protection systems. Instead, wind and flood damage are limited more by the strength of the building structure. Reinforced concrete is generally one of the strongest structural materials.

Insurance agents agree that in most areas, the losses from fire are greater than from any other cause, but these other disasters do factor in.

There are actually different insurance policies for buildings under construction versus those that are completed. For a building under construction, the developer or general contractor buys Builder’s Risk Insurance (BRI). The exact terms of a BRI policy vary from case to case, but in general it covers damage while the building is still under construction. If there is damage the insurance company pays the builder the cost of repairing or reconstructing the building to return it to its state before the damage occurred.

Commercial Property Insurance (CPI) is purchased by the building owner to cover damage after the building is complete. Similar to BRI, a CPI policy pays the owner the costs of getting the building back to its original state in the event of damage.

Questions

By getting quotes for both Builder’s Risk and Commercial Property Insurance for both wood and concrete apartment buildings we hoped to learn which material had lower insurance costs, and under what circumstances. This would also tell us how much risk the insurance industry feels each material has in different scenarios.

Our basic research questions were:

1. Is the cost of Builder’s Risk Insurance greater for concrete or wood frame multifamily buildings?

2. Is the cost of Commercial Property Insurance greater for concrete or wood-frame multifamily buildings?

3. In each case, how big are the differences?

4. Are the insurance premium savings less for concrete after construction?

5. How do all these rates vary across different areas of the country?

Methods

We set out to gather insurance quotes that would let us compare apples-to-apples.

NRMCA requested that our quotes be for a single, uniform building, and provided us with floor plans for it. This “reference building” was a four-story, 92-unit apartment building. NRMCA estimated its cost of construction in today’s market would be about $14 million, although that could vary with circumstances.

For concrete construction, we assumed that the walls would be insulated concrete forms and the floor and roof decks would be precast hollow-core plank. (NRMCA believes this to be the most common configuration for multi-floor multifamily concrete buildings.)

Because every insurer includes somewhat different coverage and services in its policies, we decided to get all insurance quotes in pairs. For example, if we wanted the cost of Builder’s Risk Insurance for the model building in Dallas, we asked a single agent for a quote for the building if it were constructed of wood and a separate quote for the building if it were constructed of concrete. We told the agent to assume that everything stays the same (location, design, policy coverage, etc.) except for the materials.

To get results more representative of the entire U.S., NRMCA asked that we get quotes for five different metropolitan areas of the country: Edgewater, New Jersey; Towson, Maryland; Orlando, Florida; Dallas, Texas; and Los Angeles, California.

We were concerned that some agents we happened to interview might have unusual circumstances and give us quotes that were different from the norm in their area.

To guard against this we got quotes from two different agents in each case. So for Builder’s Risk in Dallas, for example, we got one quote for a concrete building and one quote for a wood building from one insurance agent. Then we got a pair of quotes for the same thing from a different agent at a different company. We then did the same thing (quotes from two different agents) for the Commercial Property insurance to round out the data for Dallas. And we followed this same procedure in each of the five metropolitan areas.

In practice we had to compromise our methods a bit. The insurance agents we interviewed received no benefit from their participation in the study other than making a contribution to research. As a result, they could devote only limited time to it. Some were not able to prepare an original set of quotes for the reference building. However, some had recently prepared quotes for a similar building in their area and were willing to rerun it assuming the two different construction materials. In truth, we were not concerned so much with the exact amount of a premium for a particular building, but more with how the premium would change if the building material were changed. These quotes promised to give us reasonable estimates of the differences, so we accepted them.

Results

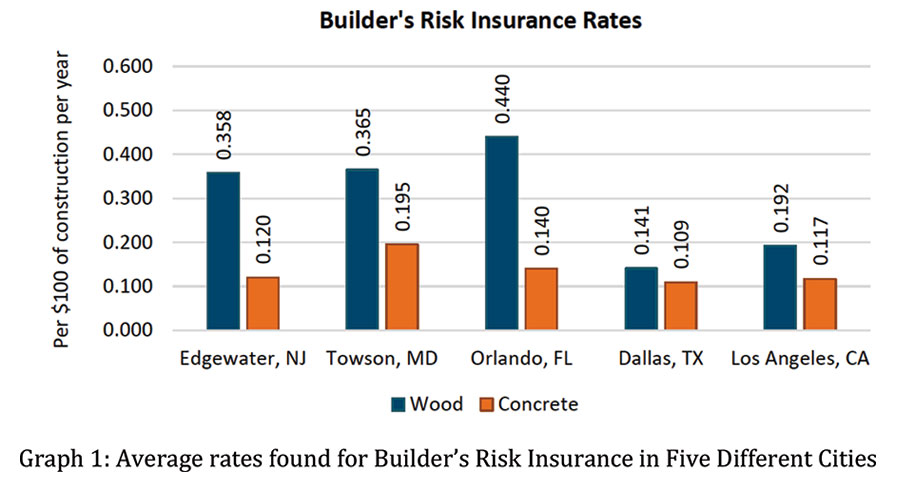

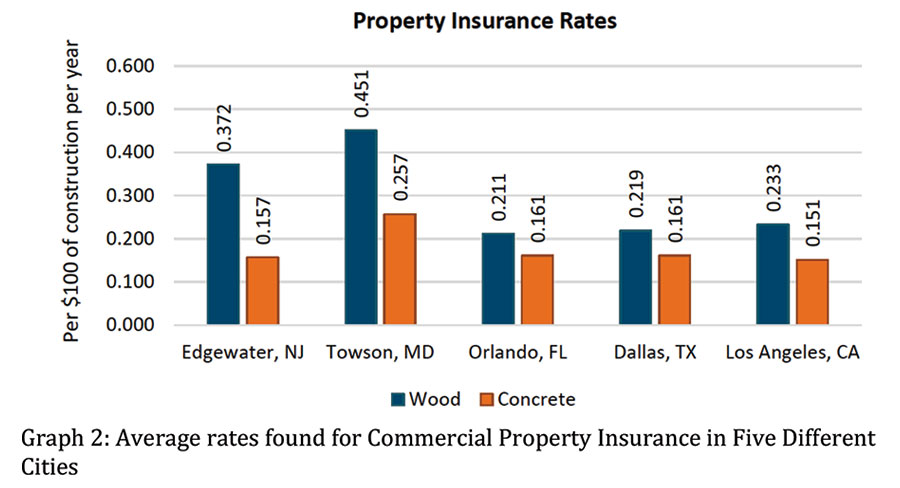

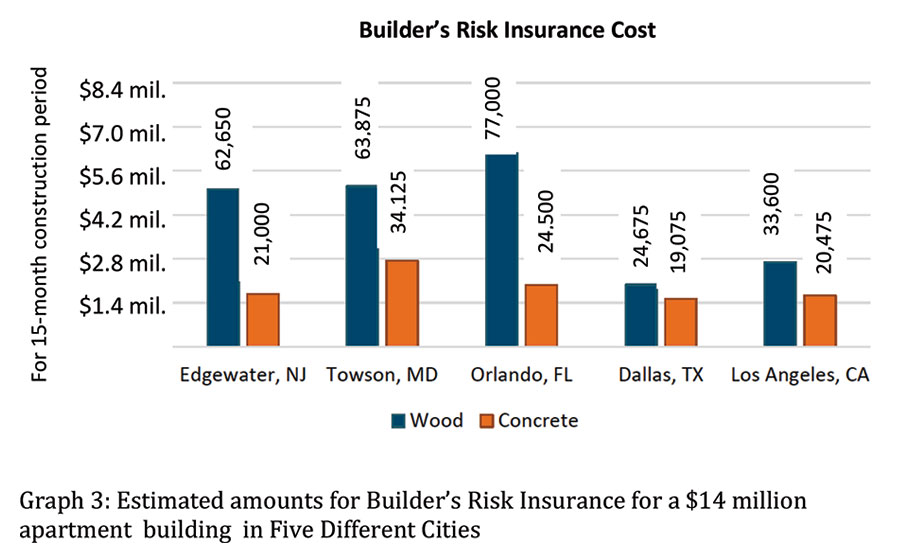

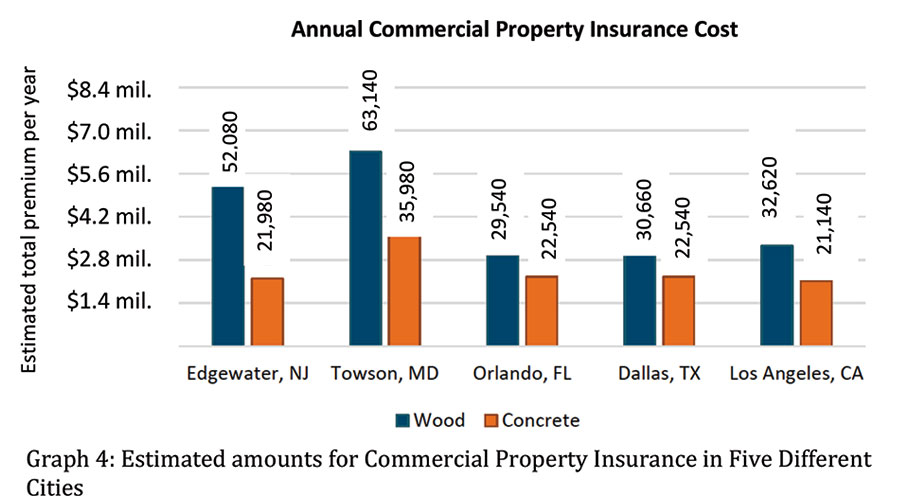

Two sets of graphs below summarize the results. Graphs 1 and 2 contain the average insurance rates we were quoted. Graphs 3 and 4 contain the total insurance bills for the reference building that we calculated from the rates.

The first obvious conclusion is that the insurance rate is lower for concrete in all cases. No matter whether the quotes were for BRI or CPI, and no matter what city they were for, the average rate for concrete was always lower.

Consider the figures for Edgewater, New Jersey: For Builder’s Risk Insurance, the average estimated premium rate for a wood building was 35.8 cents per year for each $100 of construction cost of the building. If the building cost $14 million to construct, that works out to about $50,120 per year. For a typical 15-month construction period, the total Builder’s Risk Insurance for the building would be $62,650. For concrete the rate is 12.0 cents per hundred dollars per year, for a 15-month premium of $21,000. That would be a savings for concrete of $41,650 while the building is under construction. Looked at differently, the premium for concrete is about 66% less than the premium for wood.

For Commercial Property Insurance in Edgewater, our quotes suggest that the annual premium to the owner of a $14 million building will be $52,080 per year for wood and $21,980 for concrete. That is $30,100 less per year, or about 58% less for concrete.

The figures are in the same ballpark for Towson, Maryland. They are also similar for Builder’s Risk Insurance in Orlando. However, the quotes are much lower in Orlando for Commercial Property Insurance.

And in Dallas and LA, rates overall are lower for both types of insurance. For example, in Dallas the average quoted Builder’s Risk premium works out to be $24,675 during 15 months of construction for wood, and $19,075 for concrete. This is a savings of $5,600, or about 23%. For Commercial Property Insurance, the estimated premium is $30,660 each year for wood and $22,540 for concrete. That’s a savings of $8,120 per year for concrete, or about 26%.

Conclusions

In addition to collecting the numbers, we asked the agents what factors were behind them.

They agreed that most of the cost of building insurance is to cover the fire risk. However, we can see from the numbers that completing the building and getting the fire suppression and alarm systems running usually makes little difference. In Orlando there was a big drop in the cost of insurance for a wood building from before the building was complete (Builder’s Risk Insurance) to after (Commercial Property Insurance). But for all other cities the savings from using concrete was about the same even after the building was complete.

More important is where the building is located. Agents agreed that rates may vary widely depending on local risk conditions and differences in what insurance policies include in different regions. Nonetheless, even though the overall rates change from place to place, there were always savings with concrete—often, big savings.

Although it is impossible to know the future, some of the agents felt that the difference in rates would increase in the near future. They say that the agencies have been watching the rate of fires among these new, taller wood-frame apartment buildings, and they see how frequent they have been and how big the insurance payouts are. That, they feel will lead them to increase insurance rates for the wood frame buildings. And that will increase the savings to concrete.

Pieter VanderWerf is a professor at Boston College and president of Building Works, Inc., a consulting firm that helps companies develop and commercialize new construction products. He can be reached at pieter.vanderwerf@bc.edu. The author acknowledges the contributions of Nicholas Haidari, lead researcher on this project, who made major contributions to this story.