As 2017 comes to a close, businesses of all types compile year-end statistics and compare them to the forecasts made 12 months earlier. The construction industry is no different. At this writing in mid-November, it appears ICF use is up about 6% compared to last year, although this rate of growth falls short of expectations.

This mirrors national construction trends. “The U.S. construction industry has moved into a mature stage of expansion,” says Robert Murray, chief economist for Dodge Data & Analytics. Speaking at the DD&A executive conference on Nov. 2, he explains that after fairly robust growth of 11% to 13% per year following the recession, in 2017 total construction starts advanced a more subdued 5%.

This is far different than what many expected. Kermit Baker, chief economist for the American Institute of Architects, explains, “Entering 2017, construction forecasters were quite optimistic. Not only was 2016 ending up with strong construction spending numbers, but 2017 was expected [to] provide even more momentum for this market. Tax reform and financial deregulation were going to unleash investment capital, and the repeal and replacement of the Affordable Care Act was going to reduce financial burdens on small businesses. To top it off, a trillion-dollar infrastructure program over the coming decade would directly undergird strong construction growth for the foreseeable future. However, the grounds of this euphoria are evaporating. Our economy has seen only about 2% growth, and key elements of the Trump administration’s legislative agenda have made almost no progress.”

The ICF industry is affected by a wide range of sometimes contradictory forces, and each individual market segment can be affected differently. Let’s take a look at how these trends will likely affect the future.

Residential

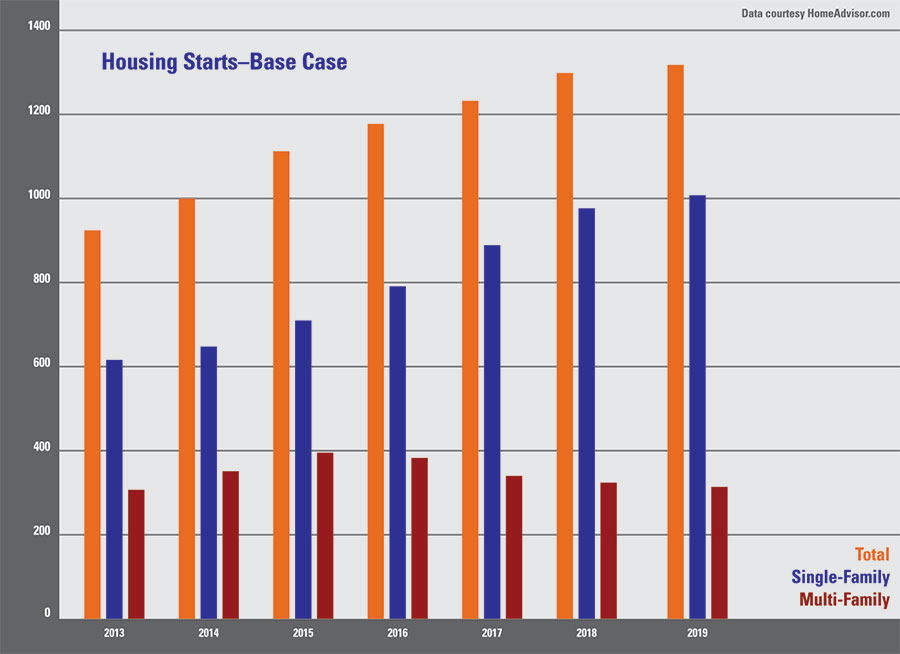

Overall, 2017 has been a solid year for residential construction. The most recent U.S. Census data (October 2017) reported that single family permits were running 9.3% percent ahead of 12 months earlier. Multifamily construction was down significantly, but the overall growth rate is 6% nationally. The experts cited above state that the residential market is finally settling down into a period of steady growth.

While few analysts feel that there is much of a risk of an economy-wide recession anytime soon, few see a significant acceleration in growth, either. The consensus is that the U.S. economy will grow in the 2.0% to 2.5% range through the end

of 2018.

It’s true that third quarter data from the Southern U.S. shows a sharp decline in housing starts, but this is likely due to Hurricanes Harvey and Irma. With the storms gone and major clean-up efforts completed, the South will likely see above-average construction through 2018, as delayed projects get underway and rebuilding efforts begin in earnest.

Across the United States, low mortgage rates, lower unemployment, and stable economic growth will boost demand for housing. Dodge Data & Analytics predicts single-family housing construction in the U.S. residential to grow by 9% next year, based on the expectation of continued job growth as well as older millennials, now in their 30s, entering the housing market.

In multifamily housing, an 8% drop is expected; following an all-time high of $95.2 billion in 2016.

Commercial

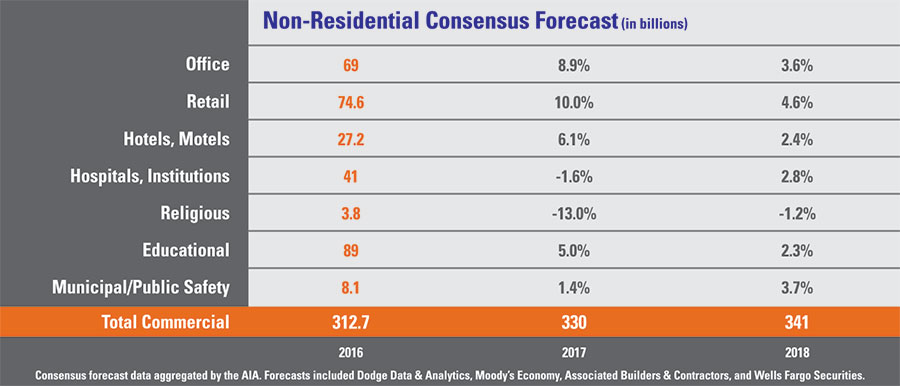

While 2016 saw commercial/industrial construction growing at 6%, overall spending for nonresidential buildings in 2017 is projected at just under 4% according to Dodge Data & Analytics.

Similarly, the Portland Cement Association (PCA) has downgraded its forecast for the public construction, predicting 2.8% growth in 2018, down from the 3.5% growth rate it predicted in May.

Institutional construction looks great on paper, but the reality is that it hasn’t affected the ICF industry at all. Murray says the big numbers there are due almost entirely to large transportation terminal construction at major airports in New York City, Los Angeles and Orlando, as well as a $1.6 billion train station in New York, none of which use ICF.

The biggest bright spot for commercial ICF construction continues to be schools. Dodge Data predicts educational facilities will see an uptick of 11% next year, to $60.3 billion. Murray also cites “gains for health-care facilities” as a cause for growth.

Reconstruction efforts following Hurricanes Harvey and Irma will also boost the industry, but Murray says that until “the specifics of a $1-trillion infrastructure program by the Trump administration materialize, activity will continue to hover around, basically, the plateau for construction starts reached a couple of years ago.”

Ed Sullivan, senior vice president and chief economist at the PCA, agrees. “Once infrastructure and tax reform initiatives take hold and affect economic and construction activity, then we can expect growth in cement consumption to accelerate to higher levels.”

Sullivan says that even if tax reform and a $250 billion national infrastructure program are passed this year, the construction industry won’t feel its effects until mid-2019.

Still, the overall commercial outlook for 2018 is cautiously optimistic. “There are several positive factors [that] suggest that the construction expansion has further room to proceed,” Murray says.

Labor

Baker, the AIA economist, points out that finding qualified labor is an ongoing problem affecting all levels of the construction industry. ICF contractors in the U.S. and Canada have reported similar concerns. In the U.S., the unemployment rate in the construction industry has fallen from around 20% in 2010 to the low single digits. Additionally, immigrant labor accounts for close to 30% of the construction labor force—most of these being Hispanics—and the recent focus on immigration could limit the labor pool even more.

To address this shortage, the ICFMA has developed a brand-generic commercial ICF installation course. It will be taught by the Mason Contractor Association of America (MCAA). The first class is scheduled for January 2018 at the World of Concrete trade show.

Code Changes

The long-term outlook for ICFs is excellent. Code standards from New York to California and north into Canada may enable ICF construction to be more cost-competitive than ever before.

Andy Lennox, chair of ICFMA, says, “Codes continue to progress in Canada. With the recent changes, below-grade concrete must be insulated to R-20 or R-24, and many basement contractors are discovering that ICF is the most cost effective way to do that. Commercial is going to see growth too.”

He predicts, “Codes are going to continue to become more strict, and while builders resist sudden, dramatic code changes, in Canada there’s a feeling among builders that quality and efficiency are something worthy to aspire to.”

Doug Bennion, training and technical director at Quad-Lock, points to a recent guide released by the British Columbia Housing Corporation as a sign that ICFs are becoming mainstream. Their recent Illustrated Guide to R-22+ Effective Walls in Residential Construction in British Columbia specifically identifies ICF as complying to the minimum R-22 effective insulation value. (Some jurisdictions in B.C., including the City of Vancouver, have mandated a minimum effective R-value of 22 for both below and above grade walls.)

Bennion says, “This might not seem like such a big deal, except that the previous version of this guide was 100% ‘wood-centric’, and made only passing mention of ICFs as an alternative building solution. While not perfect from our industry’s point of view, this revision actually represents a rather large leap forward. Additionally, we now have a seat at the table and are being consulted during formulation of similar documents.”

In the United States, California is leading the way on energy efficiency, with a proposal for all residential construction to meet net zero standards by the year 2020, and commercial construction to be net zero by 2030. (The current 2016 standard is 28% more efficient than the previous 2013 version. The 2019 code will set the bar at net zero.)

Nicholas Nikiforuk, a longtime ICF executive based in Northern California says, “Title 24 changes everything. The only way to get to net zero is ICF, SIP, or 2×6 double-stud construction with 12″ of insulation. With all the fires we’ve had in recent years—especially this summer, which has motivated leaders to really look at durability and fire resistance—concrete is going to be heavily favored in the next iteration of the codes. In a few years, ICF is going to be the most cost effective way

to build.”